Drafting a Florida claim of exemption from garnishment

The example I am working with is a Florida resident who has had his or her wages garnished to satisfy a court judgment arising from a consumer debt, and the debtor wishes to assert Florida’s Head of Family exemption as set out in Florida Statutes 222.11. The exemption is not automatic and not everyone is entitled to benefit from it. The debtor must take active steps to claim and prove that he or she is a qualified to receive the exemption.

At this point a typical non-lawyer may ask, what’s the trick? What are the magic words?

As in most other jurisdictions, Florida has done away with magic words. Florida Rules of Civil Procedure (Fla.R.Civ.P.) Rule 1.110(a) provides:

“Forms of Pleadings. Forms of action and technical forms for seeking relief and of pleas, pleadings, or motions are abolished.”

The modern way, going back sixty years or so, is called notice pleading. The practice of notice pleading calls for brief, and specific, statements of relevant facts for each of the essential legal elements of a claim for relief. Still, there are court rules that govern this method.

Fla.R.Civ.P. Rule 1.110(b) provides, in part:

“Claims for Relief. A pleading which sets forth a claim for relief . . . shall contain

. . . a short and plain statement of the ultimate facts showing that the pleader is entitled to relief . . . . “

And, Fla.R.Civ.P. Rule 1.110(f) requires:

“Separate Statements. All averments of claim or defense shall be made in consecutively numbered paragraphs, the contents of each of which shall be limited as far as practicable to a statement of a single set of circumstances, and a paragraph may be referred to by number in all subsequent pleadings. . . . . “

The first part of Rule 1.110 sets out the substance of a claim’s content as a, “plain statement of the ultimate facts showing that the pleader is entitled to relief.” The second part quoted shows the basic format is, “consecutively numbered . . . [and each] limited . . . to a statement of a single set of circumstances.”

Since the Florida Head of Family exemption is created by statute, the governing statutes are the first place to look to find the essential legal elements needed to make a valid claim. Sadly, the statutory language may not provide guidance for all situations. Researching the past decisions of Florida’s appellate courts may be necessary in some cases.

The most basic circumstance presents three essential elements:

-

- The person making the claim of exemption provides more than half the support for one or more children or other dependents, Florida Statutes 222.11;

- The money attached or garnished is due for the personal labor and services of the person making the claim of exemption, Florida Statutes 222.12, and;

- The person making the claim of exemption is the head of a family residing within the state of Florida, Florida Statutes 222.12.

As simple as this seems, there is ample room for countless complications which are not discussed in the Florida statutes. As examples of these possible difficulties:

-

- On the low end of the income scale, a working parent may receive various forms of government assistance in addition to working wages. How does this government assistance factor in to a “more than half the support” equation?

-

- A divorced parent may be entitled to receive support payments from the divorced spouse, which might be in arrears or not paid at all. Can a non-custodial parent who pays child support qualify for the exemption even if not living in the same household?

-

- If a family is a recent arrival in Florida from another state, and the original consumer debt and judgment arose in that other state, does the Florida exemption law apply? Are there any circumstances that would disqualify one from successfully claiming the exemption?

- What of non-family dependents or non-traditional family members who are dependent? Would one who supports a non-working same-sex partner qualify for the exemption?

These types of marginal issues vex lawyers and judges, and they would pose serious problems for any non-lawyer. But let us set these complications aside for the moment and proceed to drafting a plain vanilla and uncomplicated claim of exemption that would at least look like it was prepared by a real attorney. Just keep in mind that additional legal research beyond the Florida statutes may be necessary.

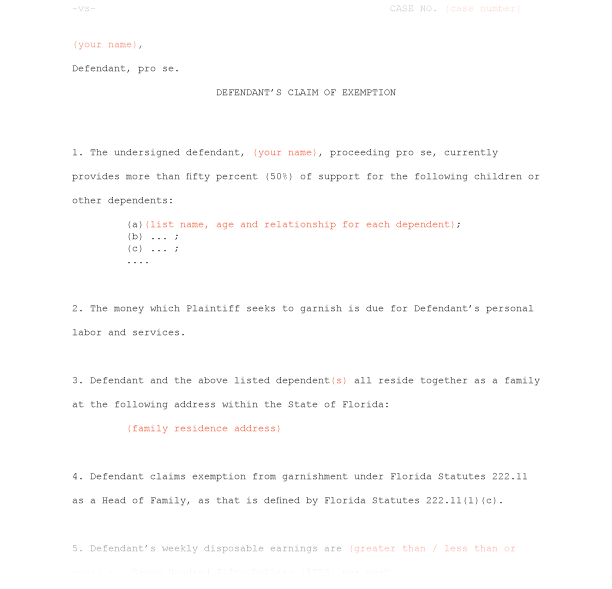

The following page image shows what an actual claim of exemption might look like in practice, with numbered paragraphs and concise statements of facts. The first paragraph goes beyond the bare minimum of what is required by including the names, ages and relationships of the claimed dependents. I did it this way for a specific tactical reason which I shall discuss another time.

The top part of the claim, the case caption, can be seen here: An eight-point case caption – a Florida example.

Is this all? Don’t be silly. There is more, but not now.

Leave a comment